40+ wells fargo mortgage prepayment penalty

Well explain the options available so. Ad Lock Your Rates Today.

Wells Fargo Fined 250 Million For Mortgage Violations American Banker

Web Many mortgages let you pay off the loan early to save money on interest.

. With a low-down payment loan mortgage insurance will be required which increases the cost of the loan and will increase your monthly payment. Web Mortgage lender information. Web 1 day agoOn March 20 2023 Wells Fargo Company NYSEWFC stock closed at 3748 per share.

Web The prepayment charge to pay off the mortgage is calculated as follows. One-month return of Wells Fargo Company NYSEWFC was. Your mortgage loan account number is used to identify your.

You can also find out by speaking to one of our assumption. Web More specifically some lenders require borrowers to pay a penalty for prepaying the mortgage sometimes the amount of this penalty is based on a sliding scale depending on how long youve held the mortgage for example if you prepay after one year you might have to pay a fee worth 4 percent of the total loan amount compared to a penalty of 3. This is important if you want to pay down your mortgage faster.

Prepayment penalties can be equal to a percentage of a. The fees can either be calculated as a percentage of the principal balance remaining on your. Ad Get Preapproved Compare Great Loan Options.

So for a 200000 non-conforming loan your. Web Section 102632a1iii provides that a closed-end credit transaction or an open-end credit plan is a high-cost mortgage if under the terms of the loan contract or open-end credit agreement a creditor can charge either a prepayment penalty more than 36 months after consummation or account opening or total prepayment penalties that exceed. Web Some loans have pre-payment penalties during the first years of the loan.

Web Most mortgage lenders charge a prepayment penalty when borrowers pay off their loan balance before the final payments due date. Web A prepayment penalty is a fee that some lenders charge if you pay off all or part of your mortgage early. Web A mortgage prepayment penalty can equal 2 of a loan balance within the first two years and 1 in its third year.

Web The actual cost of a prepayment penalty varies from lender to lender. Current mortgage balance current mortgage rate 100 4 50000 45100. Ad Our American Heritage Mortgage Loan Staff Will Help You Purchase Your Home.

For the third year the penalty is capped at 1 of the outstanding loan balance. Web If this happens unexpectedly and the borrower is unprepared the prepayment penalty for the decision can be long-lasting. Refinancing is a form of prepayment since you pay off your current mortgage and replace it with a new mortgage that has a lower interest rate or better terms.

Get Started Online Today. Lender Must Also Offer a Loan Option Without a Prepayment Penalty. Web During the first two years of the loan prepayment penalties cannot be more than 2 of the outstanding loan balance or more than 1 of the outstanding loan.

Allows the use of gift funds and down payment assistance programs. Compare Competitive Mortgage Rates Choose The Lowest. With most ATB closed.

Web 1Know your annual prepayment limits and try to stay below them. Web Amount Limitations for Prepayment Penalties For the first two years after the loan is consummated the penalty cant be greater than 2 of the amount of the outstanding loan balance. Web Not all mortgages are assumable but you can tell if you have one by the language in your note and mortgage.

Much like the cost of a mortgage loan itself an accompanying prepayment penalty cost will vary by lender. This includes your lenders name address website and phone number. Web Down payment as low as 3 on a conventional conforming.

Get Your Free Mortgage Pre-approval Online or Call Our Mortgage Loan Professionals. The prepayment penalty fee is often a percentage of. Depending on how long the.

You can do this by paying extra each month making an extra payment every year or just paying extra when you can. How Much Will a Prepayment Penalty Cost. Web Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

If you have a prepayment penalty you would have agreed. Compare Best Mortgage Companies of 2023. Web Closed mortgages usually have lower interest rates than open mortgages to compensate for the lack of prepayment and refinancing flexibility.

Apply In 3 Minutes Get Pre-Approved Today. These fees may impose substantial costs on homeowners with adjustable rate mortgage.

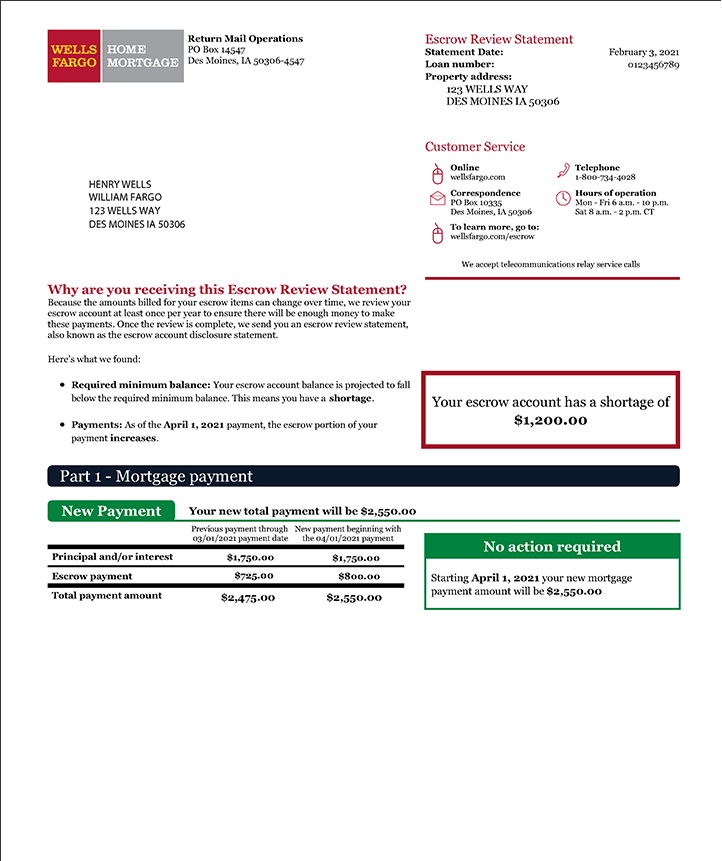

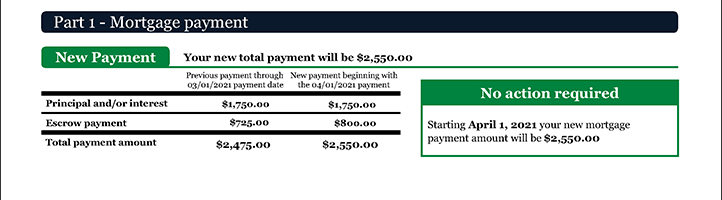

Escrow Statement Wells Fargo

Escrow Statement Payment Information Wells Fargo

Ex 10 14

Tips To Pay Off Your Mortgage Faster Wells Fargo

Tips To Pay Off Your Mortgage Faster Wells Fargo

Federal Register Hud S Proposed Housing Goals For The Federal National Mortgage Association Fannie Mae And The Federal Home Loan Mortgage Corporation Freddie Mac For The Years 2005 2008 And Amendments To Hud S

Consumer Finance 2022 Policy Preview Capstone Dc

![]()

Wells Fargo Mortgage Review 2022 Smartasset Com

Wells Fargo To Cut Back Mortgage Business After Scandals Take Toll Bloomberg

Slide Nf0vyhz30zp Jpg

Wells Fargo Mortgage Staff Brace For Layoffs As U S Loan Volumes Collapse

X1 Credit Card 2023 Review Forbes Advisor

National Mortgage Professional Magazine January 2018 By Ambizmedia Issuu

Does Your Home Loan Have A Prepayment Penalty Total Mortgage

Escrow Statement Payment Calculations Wells Fargo

Federal Register Hud S Proposed Housing Goals For The Federal National Mortgage Association Fannie Mae And The Federal Home Loan Mortgage Corporation Freddie Mac For The Years 2005 2008 And Amendments To Hud S

Wells Fargo Paused Mortgage Payments For Some Customers Without Asking